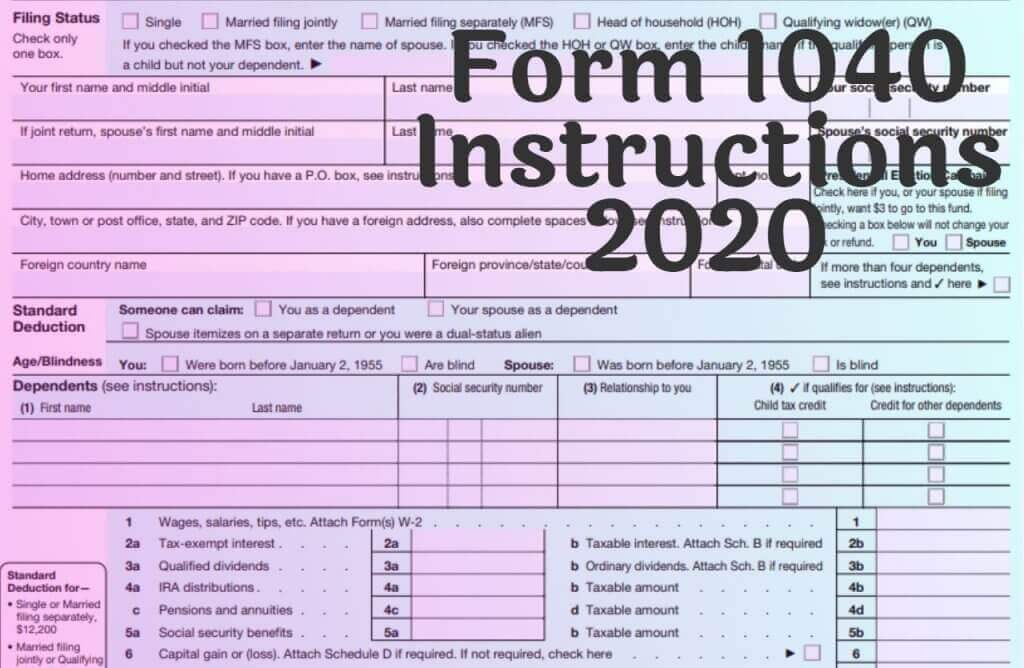

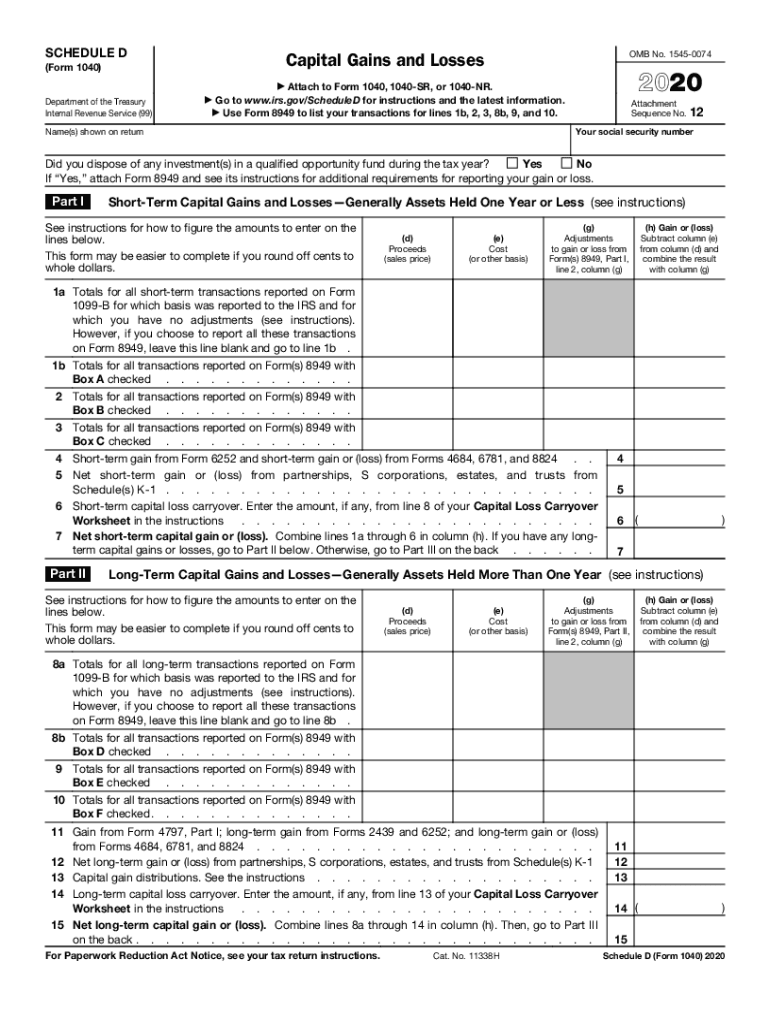

Depending on the type of income you need to report, it may be necessary to attach additional forms, also known as schedules. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. taxpayers use to file their annual income tax return. Click Download to download copies of the desired forms.The IRS 1040 form is one of the official documents that U.S. Click View/Edit, and then click Find Forms.Ĥ. Sign in using the email and password associated with your account.ģ. To make sure you have all your year-end reporting forms:Ģ. royalty or rent income) by participating in one or more Amazon programs, you may be eligible to receive a 1099-MISC if you meet the reporting threshold ($10 for royalties and $600 for all other payments).

payee and earn income reportable on Form 1099-MISC (e.g. payee and received nonemployee compensation totaling $600 or more, Amazon is required to provide you a 1099-NEC form as well as report these amounts to the IRS. Form 1099-NEC is replacing the use of Form 1099-MISC. Please log into to access all your tax forms.įorm 1099-NEC is used to report nonemployee compensation (e.g. royalty and service income), you may receive two separate forms. If you earn income reportable on Form 1099-MISC and Form 1099-NEC (e.g. Non-service income will continue be reported on Form 1099-MISC. payees on or before Februwhere it was previously reported on Form 1099-MISC.

service income) to be reported on Form 1099-NEC to U.S. The Internal Revenue Service (IRS) is requiring nonemployee compensation (e.g.

0 kommentar(er)

0 kommentar(er)